Baby Boomers Changed the World – Can They Change Aged Care?

Aged Care funding in Australia is routinely criticised for being below par in catering to the needs of our seniors.

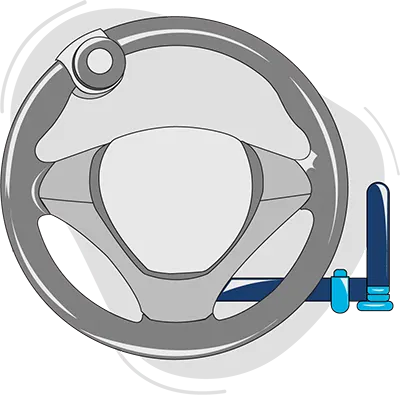

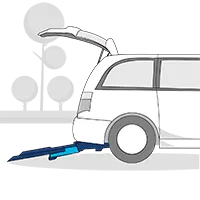

Providing tailored insurance for wheelchair accessible vehicles (WAVs) and other disability converted cars is our specialty. In addition to giving you a discount of up to 25%* off your comprehensive car insurance, our focus is to ensure your WAV or disability modified car has the cover it needs.

As Australia’s first disability equipment and car insurance specialist, Blue Badge Insurance understands the true value of disability converted vehicles and what it takes repair and replace them. You can trust us to provide great quality insurance for wheelchair accessible vehicles and more at an affordable price.

(Cover you expect from car insurance)

(What makes us different)

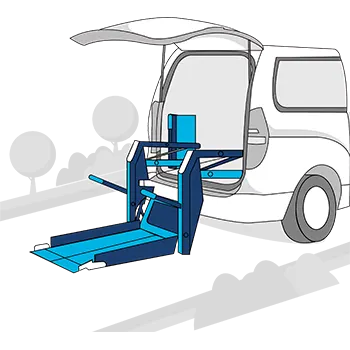

Structural changes for wheelchair accessibility

At Blue Badge, we understand how important the disability conversions are on your car. Our policy is designed to cover all your specific conversions in the event of accidental damage, loss and theft. In the event that your vehicle is stolen, damaged or written off, we will be able to offer you the sum insured shown on your Certificate of Insurance. This will include the agreed or market value of your vehicle plus any accessories, modifications and/or conversions that have been specified on your Certificate of Insurance.

Yes. If you don’t hold a Disability Parking Permit but provide regular transport for someone who does, you’re still eligible for our policy.

Yes. Our car insurance policy for disability parking permit holders covers your wheelchair while it’s in your car. We’ll pay up to $5,000 towards repairing or replacing your wheelchair or any other mobility equipment if it’s damaged or stolen while being transported or stored in your vehicle.

We also offer Wheelchair Insurance in Australia and Mobility Scooter Insurance in Australia to protect your equipment against theft, damage and liability when it’s not in use or being transported in your car.

As we’re specialists in insurance for wheelchair accessible vehicles and other disability converted cars, we know your car’s conversions are unique for your specific needs so we know it will be very difficult to find a courtesy car with the same specifications as your vehicles.

Instead, if your car is stolen we’ll pay $150 per day for up to 28 days for you to use towards a similar rental car or taxi charges.

Yes. If you’d like your policy to cover everybody who drives your car, all you have to do is tell us about them when you take out the policy with us.

If you need to make a claim, we recommend that you call us as soon as possible on 1300 304 802. Our friendly staff will ask you for the full details of the incident and will help manage your claim until it has been settled.

Depending on the circumstance of your claim, you’ll be asked to provide the following:

Many of our customers have been able to claim back a portion of their insurance premium from various funding bodies, including the National Disability Insurance Scheme (NDIS) and Transport Accidents Commission (TAC).

To help facilitate this, we clearly separate the charges associated with insuring your disability conversions on our documentation as most funding bodies only cover this component.

Yes, monthly instalments are available through a direct debit with Blue Badge Insurance. There’s a small additional fee involved with using this payment method**.

Yes, we insure anyone who holds a current Disability Parking Permit – regardless of the type of car you drive. You can find out more about our car insurance and mobility car insurance discounts for non-converted vehicles here.

Specialist Car Insurance

for People with Disability.

Aged Care funding in Australia is routinely criticised for being below par in catering to the needs of our seniors.

Heard of the Source Kids Disability Expo? It’s a free annual event for kids, teenagers, and young adults aged up

For full details of the conditions, terms, limits and exclusions and to decide whether this cover is suitable for you please read the relevant Product Disclosure Statement. Any advice provided is general only and does not take into consideration your personal circumstances. Please read the relevant Product Disclosure Statement to decide whether this cover is suitable for you.

ᵒBlue Badge Roadside Assistance is provided by Digicall Assist Pty Ltd. ABN 92 152 605 340. Please familiarise yourself with the separate Terms & Conditions of the Blue Badge Roadside Assistance. You can choose to add this Optional Benefit to your Blue Badge Insurance Comprehensive Motor Vehicle Insurance.

*Discounts for the Blue Badge Insurance Comprehensive Motor Vehicle Insurance will be applied to the base vehicle rates subject to the customer holding a permanent Disability Parking Permit and/or the vehicle has been converted for use by a driver or passengers that have a disability. The discounts do not apply to the Blue Badge Roadside Assistance Optional Benefit. Underwriting criteria will be applied to the consideration of the risk. Additional excesses will apply to drivers under 25 or those drivers who have held a full Australian drivers licence for less than 2 years. This offer may be withdrawn at any time.

^ New for old replacement on conversions up to 5 years old from newly installed to a maximum value of $75,000.

~ For mobility equipment valued up to $10,000. Discounts will be applied subject to the nature and history of the risk. Underwriting criteria will be applied to the consideration of the risk. This offer may be withdrawn at any time.

** For new policies commencing on or after 9 April 2020 with a policy number starting with BBMC. Monthly payments are organised direct through Blue Badge Insurance. Payments are available by direct debit from your nominated credit card or bank account. Direct debits will occur on the same day of each month and incur an additional fee of 4%.

For new or renewal policies with a policy number starting with BCM or MOT. Monthly payments are organised with Attvest Finance Pty Ltd. Payments are subject to their own terms, conditions and limitations and a monthly fee will apply that includes interest, taxes and charges.

We encourage all policyholders to be aware of suspicious activity, in order to protect against fraud and scams. For information on how to stay safe from scams please visit ACSC, Moneysmart and the Office of the Australian Information Commissioner.

Blue Badge Insurance: Blue Badge Insurance is a product of Pacific International Insurance Pty Ltd (ABN 83 169 311 193 | AFS Licence No. 523921).

The Fine Print: We use cookies to optimise the design of our websites. By continuing your visit on this website, you consent to the use of cookies. Find out more about cookies and how we use them here.

Terms, conditions, limits, exclusions and excesses may apply.

Coverage, premiums and savings are subject to rating, underwriting and individual criteria. A Target Market Determination (TMD) is available.

Any advice on this website does not take into account your individual objectives, financial situation or needs. Please consider our Financial Services Guide (FSG).

Any information, discussion and/or resource contained on this website has been prepared with the utmost care and good faith at the time of publishing. We do our very best to ensure that materials are current, up to date and in keeping with our product offering at the time of publishing, but some historic material on this site may contain references to older offerings. Accordingly, we do not represent or warrant that all material on this site is relevant to our current product offering.

Before making a decision about any product, please consider the relevant Product Disclosure Statement (PDS).

Blue Badge Insurance Australia Pty Ltd. PO Box 550, Kotara, NSW, 2289

Blue Badge Insurance Australia © 2024 | All Rights Reserved.