Australia’s Disability Support Pension (DSP) is a vital form of government financial assistance for those living with disability. However, advocacy groups have raised concerns that it’s a complicated process and the high eligibility requirements are exclusionary. Nevertheless, those who are eligible benefit from the stable income this disability grant provides.

In this article we look at what it is, how it differs from the National Disability Insurance Service (NDIS), who qualifies, what people are complaining about, how much funding it involves and how to access it.

In this article

What is the Disability Support Pension?

The Disability Support Pension is a social grant from the Australian government. It’s given to those who have a permanent physical, intellectual, or psychiatric medical condition that stops them from working. Having a disability or medical condition does not qualify you for DSP until you prove the condition prohibits you from working.

To receive the Disability Support Pension, you must be medically assessed and diagnosed, and be unable to work at least 15 hours a week for at least two years. Administration and payment of it is handled by Centrelink, the government organisation that delivers income support and other payments to Australians.

How is it different to the NDIS?

The National Disability Insurance Service (NDIS) is a government program that assists Australians who are born with or acquire a permanent and significant disability.

NDIS funding is granted to individuals for the purpose of helping them pay for support and services related to their disability that helps them reach their goals. In other words, for a new wheelchair, physiotherapy, or home modifications intended to make a more accessible home. Check out our NDIS guru’s article on the steps to access the NDIS, as well as these useful NDIS resources:

- Will the NDIS Contribute Towards Your Insurance Costs?

- NDIS Guru – Will the NDIS Fund My Wheelchair?

- NDIS Guru – Things I Wish I Knew Before Becoming Involved in the NDIS

The Disability Support Pension, on the other hand, is a set, recurring amount of money paid to qualifying individuals who have one or more disabilities that stop them from working. It’s intended to take the place of an individual’s wages. Unlike the NDIS, this disability grant can be used to pay for living costs, things that aren’t related to the person’s disability – from food to utilities to leisure activities.

The two schemes are entirely different, and being eligible for one won’t disqualify you from applying for the other. Just keep in mind that the NDIS will not pay for anything that’s already covered by another system. You can learn more about the difference between the two here:

Who is eligible for the Disability Support Pension?

You need to meet medical and non-medical criteria in order to access this disability grant. Manifest medical criteria that would qualify you include one or more of the following:

- Permanent blindness

- Requiring a nursing home level of care

- An intellectual disability with an IQ of less than 70

- Category 4 HIV/Aids

- A terminal illness with a life expectancy of less than two years

- You get a Department of Veterans’ Affairs Disability Compensation Payment at the Special Rate

You may qualify for the Disability Support Pension if you have any of the above, however you will still need to meet certain non-medical criteria. If you don’t meet any of the above manifest medical criteria, you may still be able to apply if you meet these general medical rules.

Non-medical criteria include:

- Being at least 15 years and 9 months of age and under the Age Pension age, which is at least 66.5 years of age (read more about this here)

- Being an Australian resident of at least 10 years or have resided here for a total of 10 years with at least five of those years being continuous residency, or you become unable to work while living in Australia

- Passing the income test

- Passing the asset test

The DSP has a useful test you can take to check your eligibility before claiming. Here’s some valuable information on what will make you eligible:

How much is the DSP?

Services Australia updates the payment rates for the Disability Support Pension on 20 March and 20 September each year if you’re either:

- 21 and older, with or without children, or

- younger than 21 with a child in your care.

This is to keep welfare payments ‘real’ in terms of inflation, cost of living and movements in wages.

As for those younger than 21 years of age who don’t have children, their rate is updated on 1 January each year.

Latest update

On 1 January 2024 it was announced that DSP (Youth) recipients will receive a 6% a fortnight increase to their payments. The rates of pay differ according to personal circumstances, but this works out to about an extra $31.10 to $44.90 a fortnight.

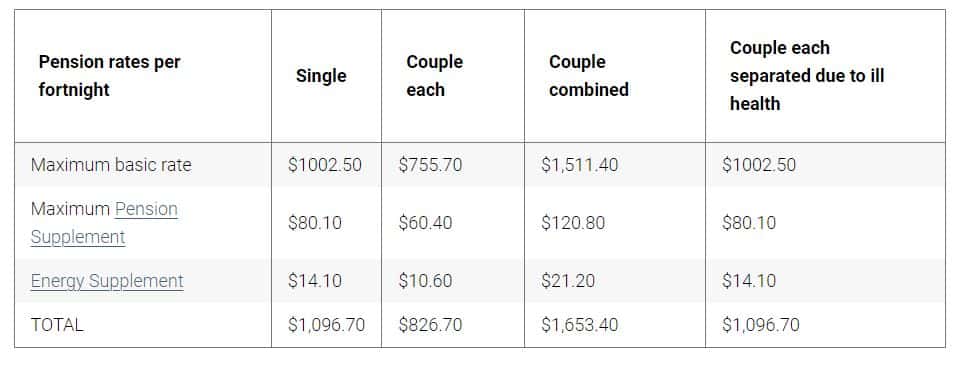

As of January 2024, here are the maximum payment rates if you’re 21 years and over, with or without children, or younger than 21 with a child in your care:

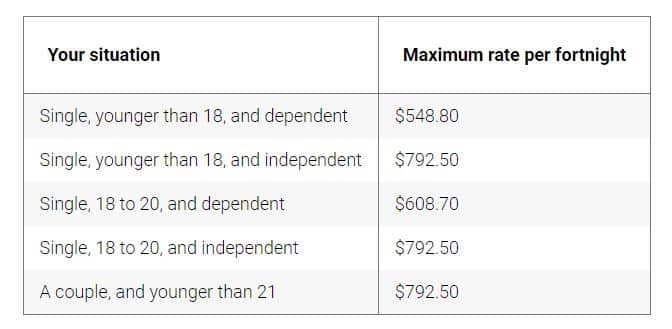

If you’re younger than 21 and don’t have any dependent children in your care, different rates apply. They’re worked out according to whether Services Australia assesses you as dependent or independent:

How do I claim the Disability Support Pension?

Once you’ve determined that you’re eligible to claim the DSP, the easiest way to do so is online. You need a myGov and Centrelink account first, which you can set up here.

You also need to gather all your supporting documents. These include medical, financial, study and employment/work documents. You’re going to be required to provide medical evidence, including:

- your past, current and planned treatment

- how your condition impacts you day to day

- the names and contact details of your treating doctors

- your symptoms

- your prognosis

As mentioned before, qualifying for the disability support pension can be a long and complicated process. Be sure to check your eligibility status before you start your application.

What are people’s complaints about the DSP?

While the Disability Support Pension is crucial support for many, there are some criticisms about it. The community definitely has lots of gratitude for the financial support the DSP provides, however, there’s also frustration about the system’s complexities, inadequacies, and the way it’s managed.

Many in the disability community see the DSP as essential support, but find the process of accessing it stressful, for example. Here are some common issues with it:

Application process stress

The process of applying for the DSP can be anxiety-inducing and demeaning due to the need for extensive medical evidence and the fear of rejection or judgement.

Insufficient support

Some believe the DSP doesn’t offer enough financial support, especially considering the high costs associated with certain disabilities, like healthcare, mobility aids, or modifications needed in the home. Plenty of people with disability find their NDIS funding doesn’t cover everything they require. So, they need their DSP to cover it but it’s not enough.

Fear of losing benefits

There’s a common worry about engaging in work or improving one’s situation for risk of having their pension taken away, due to strict rules around income and disability reassessments. This can lead to a fear of losing DSP benefits if their condition improves or if they earn over a certain threshold.

Stigma and misunderstanding

There’s sentiment that the broader public and sometimes even policymakers don’t fully understand the challenges faced by people with disabilities. This lack of understanding can lead to stigma and stereotypes about people on the DSP.

Desire for more comprehensive support

Many in the disability community advocate for more comprehensive support – i.e., going beyond the financial assistance of this disability grant. This includes better access to healthcare, employment support, and social inclusion initiatives.

PS: On top of the Disability Support Pension, you may also be eligible for a mobility allowance for transport. Read beyond the disability grant and into this: “What is the Mobility Allowance: Budget, Eligibility and Options.”

Protect what matters

At Blue Badge Insurance, we understand how important your mobility is to you. That’s why we insure what’s important: disability converted cars, wheelchair accessible vehicles, wheelchairs, and mobility scooters. There’s also Blue Badge Pet Insurance and Assistance Dogs insurance.

With us you can get up to 25% off disability car insurance, too. This applies to all disability parking permit holders – even if your car isn’t modified. Contact us today to get a quote.